In addition to the rent and other sums to be paid hereunder by LESSEE LESSEE shall pay a pro rata share of the following expenses of LESSOR related to Building II andor the common areas of BRANDYWINE CENTRE II. Indemnity Clauses and Anti-Indemnity Legislation.

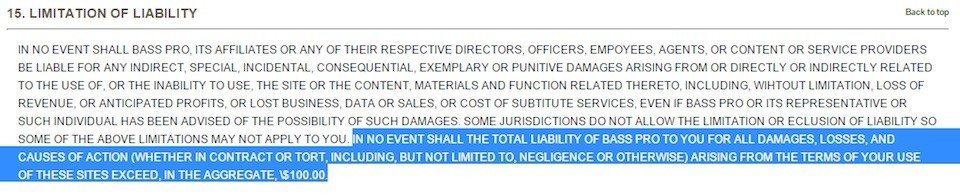

Draft Limitation Or Exclusion Of Liability Clauses Termsfeed

A pro rata liability clause is a stipulation in an insurance policy that obliges the insurance company to cover only a percentage of a loss if the insured has other policies from other companies covering the same risk.

. Pro Rata Liability means the applicable Shareholder or Partner s Allocable Portion multiplied by the amount of damages or liability caused by such claim or series of related claims and calculated separately for each such claim or series of related claims causing such damage or liability. The pro rata liability clause is designed to protect the principle of The two major actions required for a policyholder to comply with the Reinstatement Clause are Life insurance policies will normally pay for losses arising from. Hence the adoption of other insurance clauses designed to overcome this problem which we today recognize as pro rata excess and escape clauses so-called.

LESSEES pro rata share shall be the product obtained by multiplying. Pro rata allocation - divides the liability amount equally among the policy years triggered. The clause typically provides as follows.

Based on 1 documents. In the event of a total loss to the building what would each insurer pay. Underwriters the Non-Cumulation Clause was designed to thwart a policyholder that was.

Company A carries 13 of the total coverage 20k 40k 60k. Pro rata clauses keep claims payouts fair in cases where multiple insurers cover the same asset. Pro rata allocation.

In a Bankruptcy case when the debtor is insolvent creditors generally agree to accept a pro rata share of what is owed to them. The pro rata liability clause is designed to protect the principle of. All groups and messages.

Each policy is written for 100000 and each has the pro rata liability other insurance clause. The pro rata liability clause is designed to protect the principle of A. A clause sometimes contained within a policy that provides payment of a loss for which the insurer is liable to the insured to someone other than the insured.

A claim will only be paid out on an asset based on the insurable interest that the policy. Purpose and Enforceability of Indemnity Clauses. Waiver and estoppel C.

A third party who has an insurable interest in the property covered under the terms of an insurance contract. Each policy pays a percentage of the loss based on the percentage of coverage that policy provides. Continue to protect the Assured for liability in respect of such personal injury or property damage without payment of additional premium.

Would escape its liability altogether. If the debtor has any remaining funds the money is divided proportionately among the. 16 Christopher French.

Pro rata liability clause. Continue to protect the Assured for liability in. When a loss happens and the person has more than one policy covering that loss companies that issued the policies share the coverage equitably and not one of them pay the insured the exact amount.

Insuranceopedia Explains Pro Rata Liability Clause. A pro rata clause is a clause in an insurance policy which states that each insurer providing coverage for an asset will pay out claims for that asset in proportion to the coverage percentage for the asset that it is providing. After the insurer covers that percentage the other companies pay for the rest.

For example there are three different policies covering a. If the insured has other insurance against liability covered by this policy the company shall not be liable for a greater proportion of such loss. Each policy will pay 25000 for the loss.

The pro rata liability clause is designed to protect the principle of concurrent coverage if more than one policy is in force on the same property at the same time covering the same perils. A pro-rata clause which purports to limit the insurers liability to a proportionate percentage of all insurance covering the event. Therefore it is responsible for 13 of the 24000 loss or 8000.

Pro rata liability applies. The pro rata liability clause is designed to protect the principle of Indemnity If more then one policy is in force on the same property at the same time covering the same perils this is concurrent coverage. The introduction of prora-tion provisions and restricted use exclusions became a common.

Latin Proportionately A phrase that describes a division made according to a certain rate percentage or share. An escape or no-liability clause which provides that there shall be no liability if the risk is covered by other insurance. Provision in many property insurance policies that spreads the obligation to pay a claim among various insurers covering that claim in proportion to the insurance each has written on the property.

PRO RATA SHARE OF EXPENSES AS ADDITIONAL RENT. Pro rata condition of average relates to the proportion of an asset that an insurance policy covers. Pro-Rata The pro-rata clause provides that the insurance carrier will not be liable for more than its pro-rata share of the loss.

Indemnification is an equitable doctrine that. Underwriters the Non-Cumulation Clause was designed. This clause is meant to prevent a person from profiting from a loss instead of being merely covered for it.

Draft Limitation Or Exclusion Of Liability Clauses Termsfeed

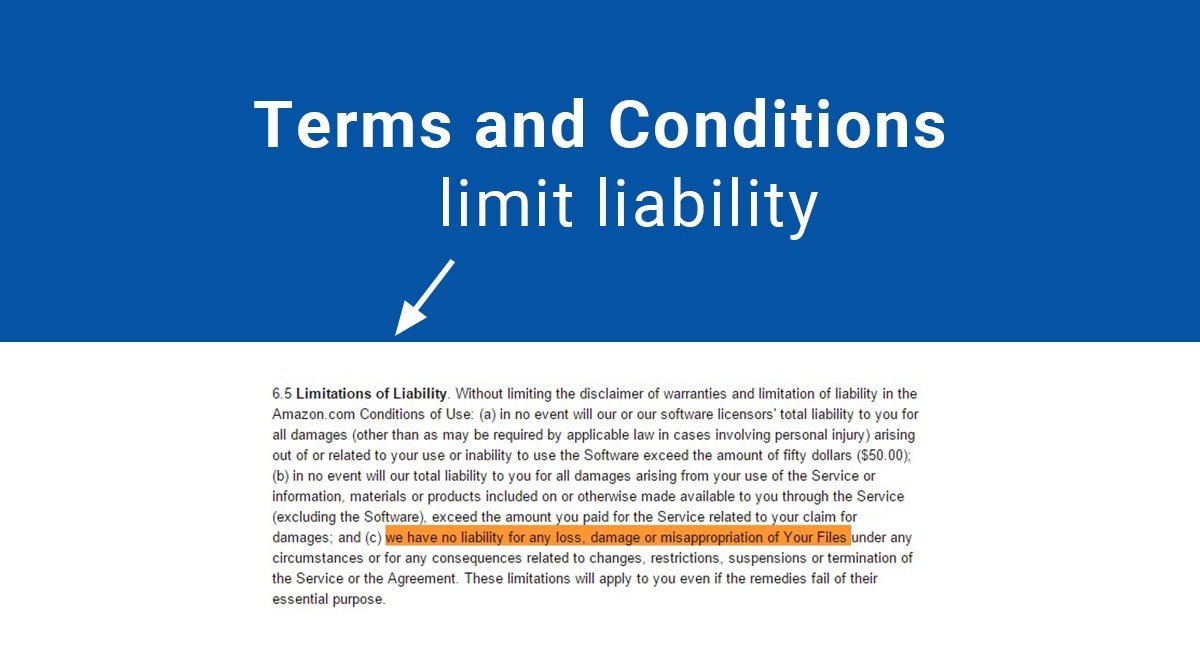

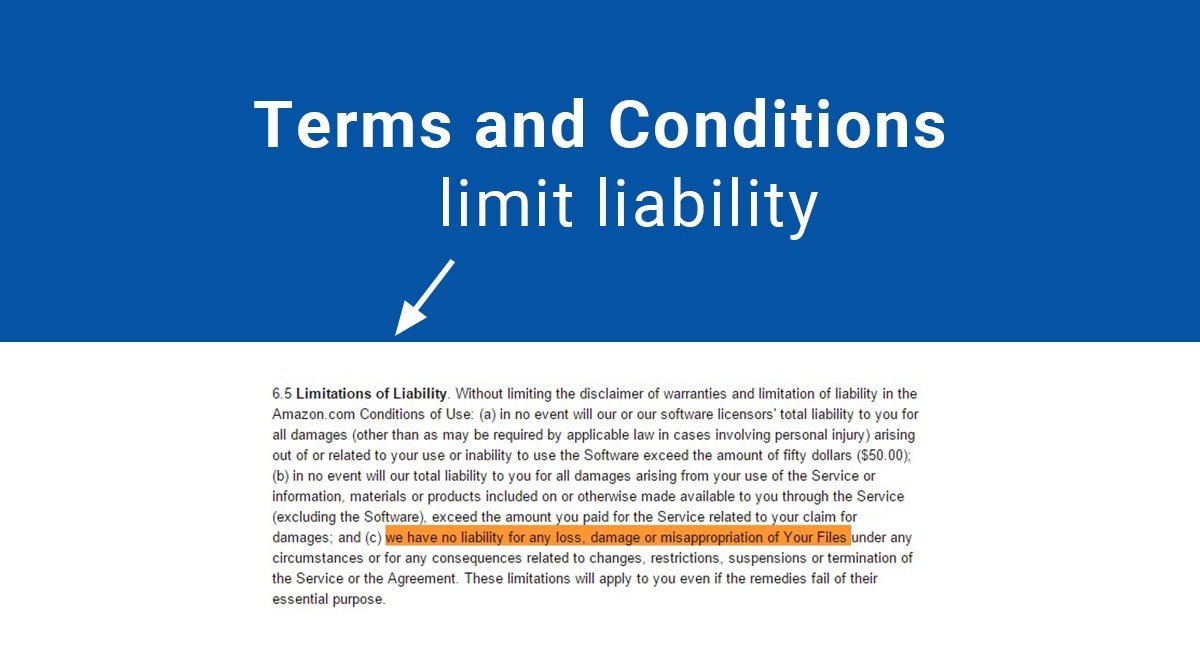

Using Terms Conditions To Limit Liability Termsfeed

Definition Of Pro Rata Clause In Insurance

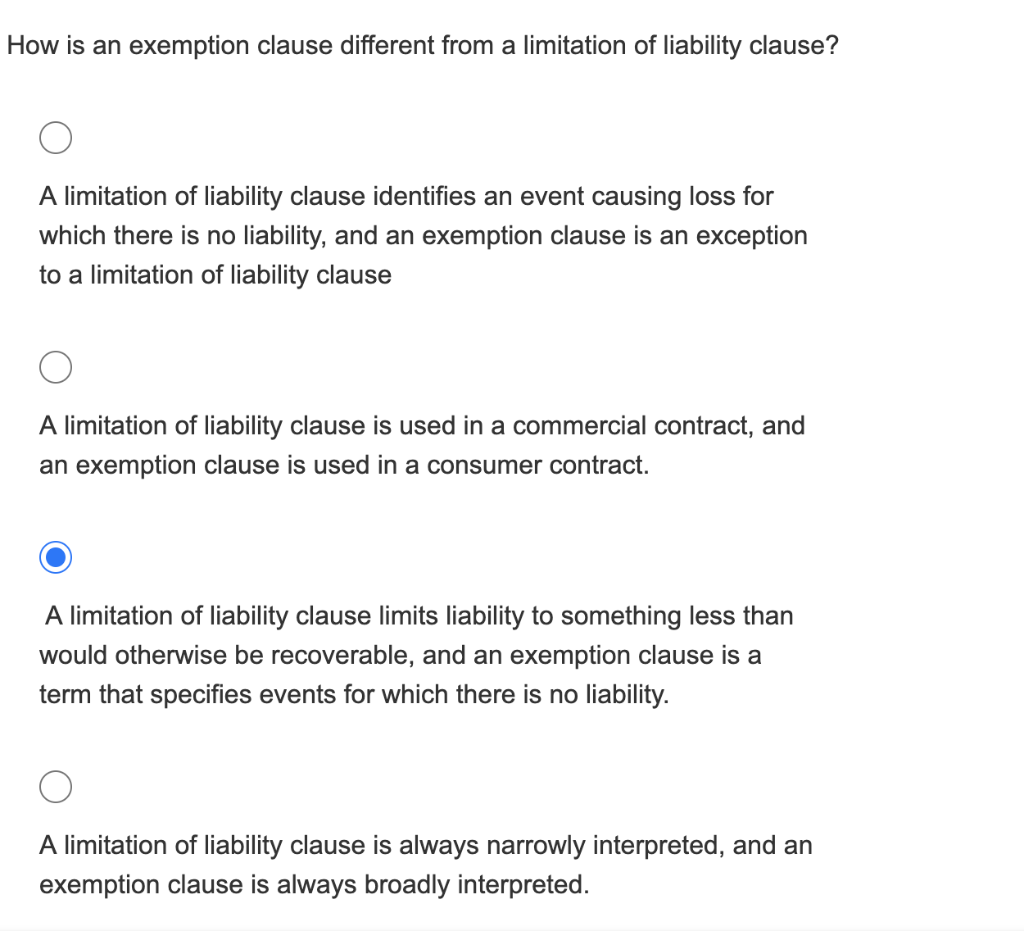

Solved How Is An Exemption Clause Different From A Chegg Com

0 comments

Post a Comment